Contact Us Now for Trustworthy Debt Consultancy in Singapore

Contact Us Now for Trustworthy Debt Consultancy in Singapore

Blog Article

Unlock the Advantages of Engaging Financial Obligation Professional Provider to Browse Your Path Towards Financial Obligation Relief and Financial Flexibility

Engaging the solutions of a financial obligation expert can be a crucial step in your trip towards accomplishing debt alleviation and financial security. The inquiry remains: what details benefits can a financial obligation specialist bring to your financial scenario, and how can you identify the best companion in this venture?

Recognizing Financial Debt Professional Provider

How can financial debt specialist services transform your economic landscape? Financial debt specialist solutions use specialized advice for people grappling with monetary difficulties. These specialists are educated to analyze your financial circumstance adequately, supplying tailored techniques that line up with your special conditions. By evaluating your earnings, financial debts, and expenditures, a financial debt consultant can help you determine the origin triggers of your economic distress, allowing for a more accurate approach to resolution.

Financial obligation professionals commonly employ a multi-faceted strategy, which might include budgeting aid, arrangement with creditors, and the growth of a tactical settlement strategy. They function as intermediaries between you and your financial institutions, leveraging their expertise to negotiate extra desirable terms, such as decreased rates of interest or extended payment timelines.

Moreover, financial obligation experts are furnished with current expertise of relevant regulations and policies, ensuring that you are educated of your legal rights and alternatives. This professional support not only minimizes the psychological worry connected with debt yet likewise equips you with the tools required to restore control of your economic future. Inevitably, engaging with debt expert solutions can lead to a more educated and organized path toward economic stability.

Trick Advantages of Professional Support

Involving with financial debt expert services provides numerous advantages that can considerably enhance your monetary scenario. One of the main benefits is the proficiency that professionals bring to the table. Their extensive expertise of debt management methods permits them to tailor options that fit your special conditions, making certain a much more efficient strategy to achieving economic stability.

Furthermore, financial obligation experts often offer negotiation help with creditors. Their experience can cause a lot more desirable terms, such as lowered rate of interest or settled debts, which may not be achievable with straight arrangement. This can result in significant financial relief.

Furthermore, specialists provide a structured prepare for settlement, aiding you focus on financial obligations and assign resources efficiently. This not just streamlines the settlement procedure yet likewise fosters a sense of responsibility and development.

Eventually, the combination of professional support, negotiation skills, structured repayment plans, and psychological assistance placements financial obligation professionals as useful allies in the pursuit of financial obligation relief and monetary flexibility.

Just How to Choose the Right Professional

When choosing the ideal financial debt specialist, what key variables should you consider to ensure a positive result? Initially, examine the consultant's credentials and experience. debt consultant services singapore. Search for certifications from recognized organizations, as these indicate a level of professionalism and expertise in debt monitoring

Next, take into consideration the consultant's reputation. Study online evaluations, endorsements, and ratings to determine previous clients' complete satisfaction. A strong performance history of effective debt resolution is important.

In addition, assess the specialist's method to financial debt administration. A great professional ought to use tailored services customized to your unique financial scenario as opposed to a one-size-fits-all solution - debt consultant services singapore. Transparency in their procedures and costs is important; guarantee you understand the prices entailed prior to dedicating

Interaction is another crucial aspect. Pick a professional who is approachable and eager to answer your inquiries, as a solid working relationship can boost your experience.

Common Debt Alleviation Strategies

While various financial obligation relief approaches exist, picking the best one depends upon individual monetary scenarios and objectives. A few of one of the most typical techniques consist of financial debt combination, financial debt monitoring strategies, and financial debt negotiation.

Financial obligation consolidation involves combining multiple financial debts into a solitary financing with a reduced passion price. This method simplifies settlements and can browse around here decrease month-to-month obligations, making it less complicated for people to regain control of their funds.

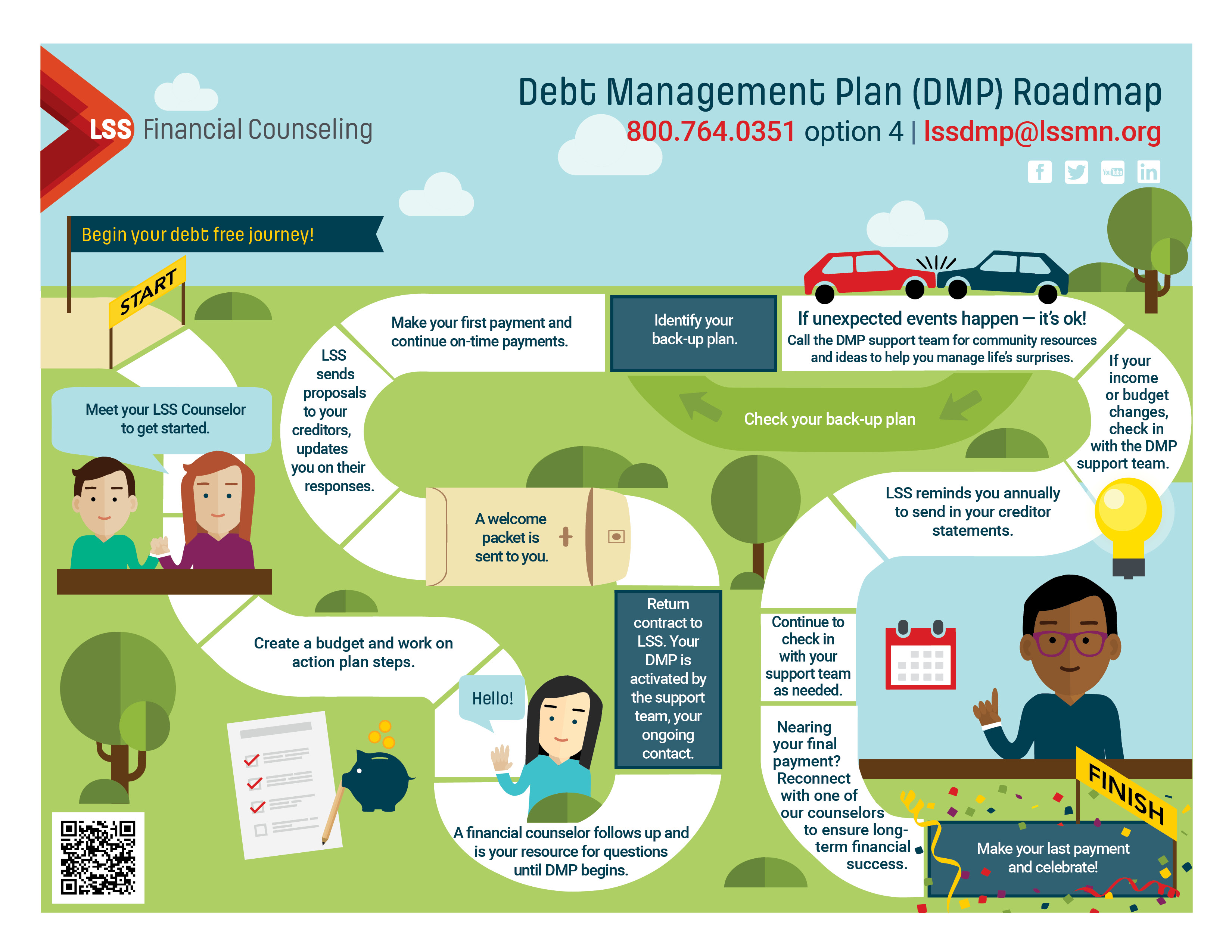

Financial obligation monitoring plans (DMPs) are created by credit rating therapy firms. They negotiate with creditors to lower rate of interest and produce a structured repayment plan. This alternative allows individuals to pay off financial debts over a set period while taking advantage of professional support.

Financial debt negotiation involves bargaining directly with lenders to settle financial obligations for much less than the overall amount owed. While this technique can offer prompt relief, it might affect credit report and usually involves a lump-sum repayment.

Finally, personal bankruptcy is a lawful alternative that can offer remedy for overwhelming financial debts. Nonetheless, it has long-term monetary implications and ought to be thought about as a last resort.

Picking the proper technique requires mindful assessment of one's economic circumstance, ensuring a customized approach to attaining long-term stability.

Steps Towards Financial Flexibility

Following, develop a reasonable budget plan that focuses on basics and cultivates savings. This budget ought to include stipulations for debt repayment, allowing you to designate excess funds properly. Adhering to a budget plan aids grow self-displined investing routines.

When a budget plan is in location, consider engaging a financial debt expert. These experts use tailored techniques for managing and minimizing financial obligation, supplying insights that can expedite your trip toward financial liberty. They might suggest options such as financial debt consolidation or arrangement with lenders.

Additionally, emphasis on building an emergency fund, which can protect against future monetary strain and provide assurance. Finally, invest in monetary literacy via resources or workshops, making it possible for notified decision-making. With each other, these steps develop an organized approach to accomplishing financial liberty, transforming ambitions into fact. With commitment and notified actions, the prospect of a debt-free future is within reach.

Conclusion

Engaging financial debt specialist solutions supplies a tactical approach to accomplishing financial obligation alleviation and economic liberty. These specialists offer important assistance, tailored approaches, and emotional assistance while making sure conformity with appropriate regulations and regulations. By prioritizing look at this now financial debts, working out with creditors, and applying organized repayment plans, individuals can gain back control over their economic scenarios. Inevitably, the experience of financial debt specialists substantially improves the probability of browsing the intricacies of debt management efficiently, resulting in a more safe and secure financial future.

Engaging the solutions of a financial debt specialist can be an essential step in your trip towards achieving debt alleviation and economic stability. Debt expert solutions use specialized guidance for people grappling with financial obstacles. By examining your revenue, financial debts, and costs, a financial debt expert can help you recognize the origin causes of your economic distress, enabling for Check Out Your URL a more accurate strategy to resolution.

Engaging financial debt consultant solutions provides a critical method to attaining financial obligation relief and financial flexibility. Inevitably, the proficiency of financial obligation professionals dramatically enhances the probability of browsing the intricacies of financial obligation management successfully, leading to an extra protected monetary future.

Report this page